Dive into one of the fastest-growing industries through the latest statistics on affiliate marketing. This article unravels comprehensive data on the state of the industry worldwide, stateside, and across the pond. Read on for the details on budgeting and spending, ROI and success measurement, advertisers’ and publishers’ views, and more!

Affiliate Marketing Facts – The Highlights

- The global affiliate marketing industry worth is estimated at $15.7 billion.

- Affiliate marketing spending in the US alone is over $8.2 billion.

- There are over 113,400 affiliate networks worldwide.

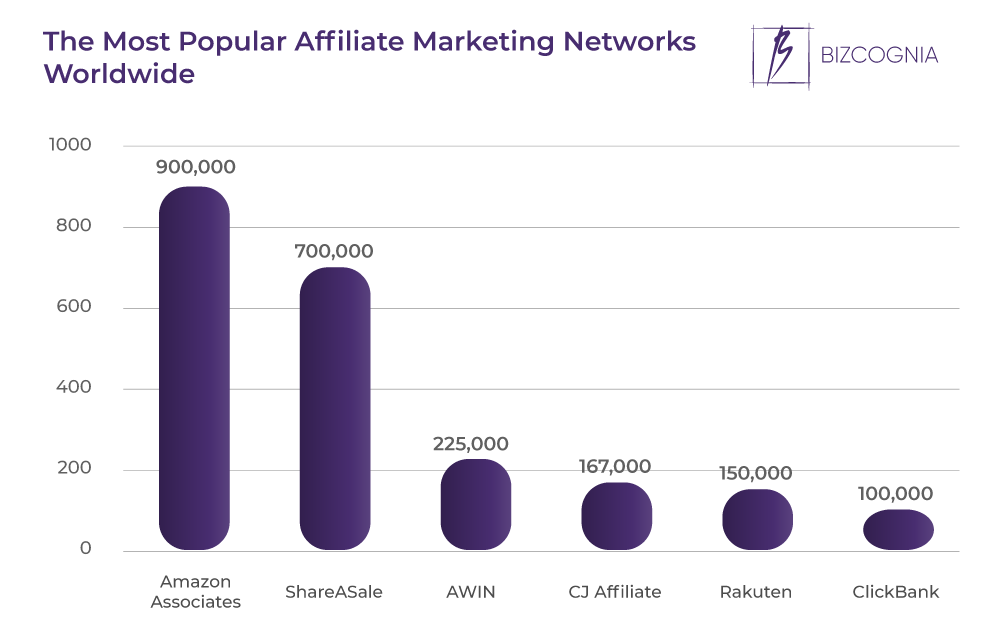

- The six most popular affiliate marketing networks worldwide are home to over 2.2 million affiliates.

- The largest portion of the global affiliate marketing revenue is generated in the retail industry.

- The industry lost $3.4 billion to fraud in 2022.

- 84% of publishers create content for affiliate marketing.

- 81% of advertisers include affiliate marketing in their overall marketing efforts.

- Affiliate marketers make an average of $54,404 a year.

- Affiliate marketing drives over 1% of the United Kingdom’s GDP.

Affiliate Marketing Industry Statistics

How big of an industry is affiliate marketing?

The latest available data reveals that the global affiliate marketing industry is valued at $15.7 billion. By the end of 2027, the affiliate marketing industry size is estimated to grow at a CAGR of 9.89%, reaching $27.7 billion.

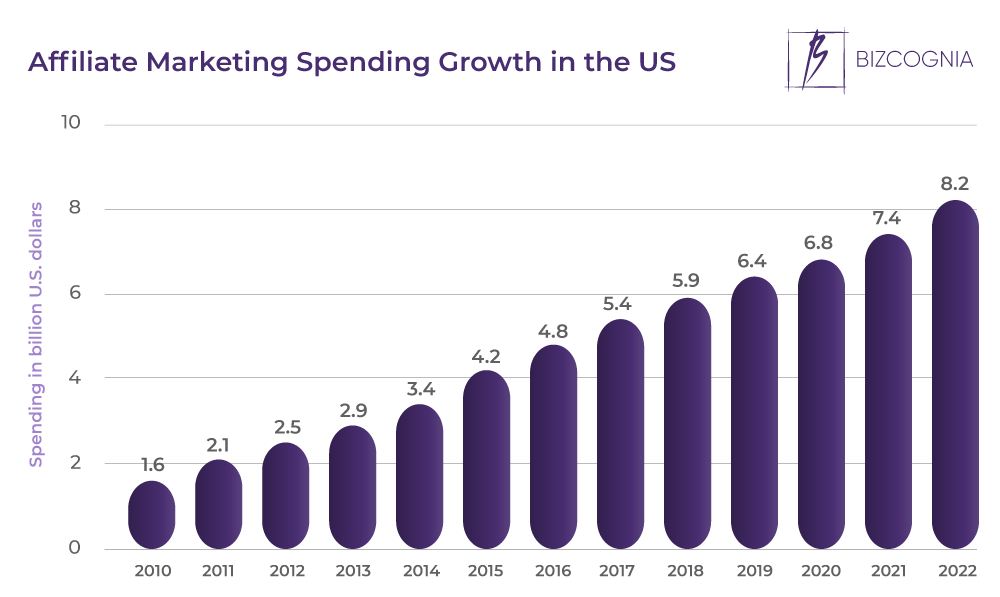

Affiliate marketing spending in the US alone was estimated at $8.2 billion in 2022.

Affiliate marketing growth in spending has been on a consistent and steady rise since 2010, when it stood at $1.6 billion, indicating a near 14% CAGR between 2010 and 2022.

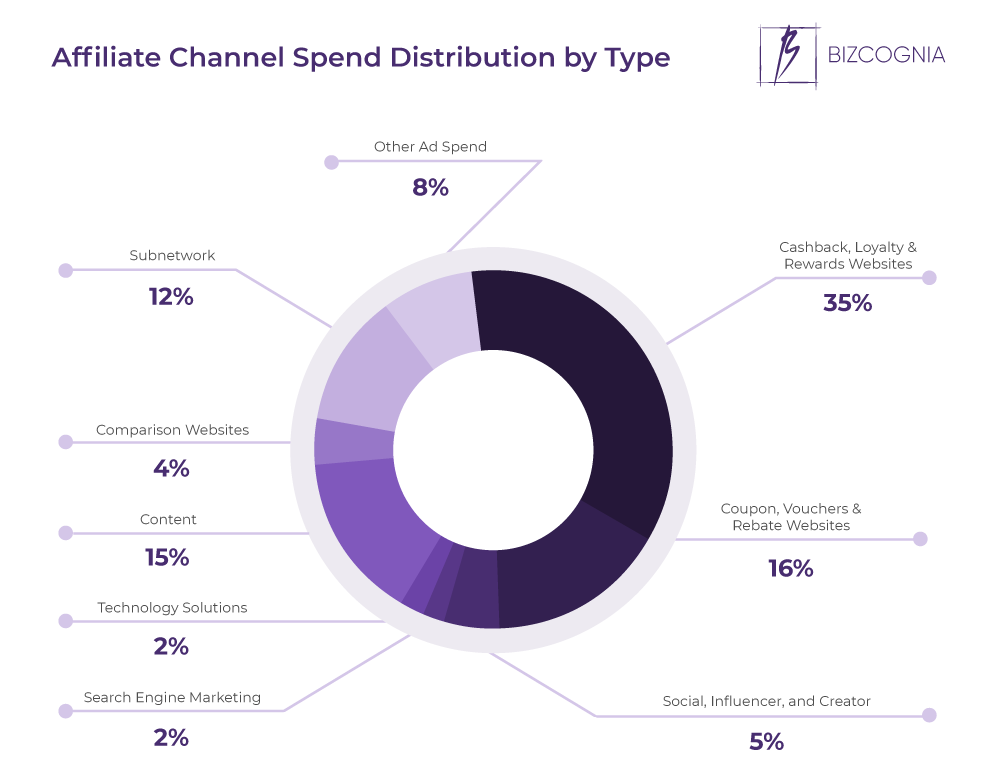

The largest portion, or 35%, of the affiliate channel spend goes to cashback, loyalty, and reward websites.

Coupon, voucher, and rebate websites rank second with 16%, followed by content with 15% and subnetworks with 12%.

Social, influencer, and creator expenses account for 5% of affiliate marketing spend, while comparison websites get 4%, and search engine marketing and tech solutions each get 2%.

8% of affiliate marketing spend goes to other expenses.

There are over 113,400 affiliate networks worldwide.

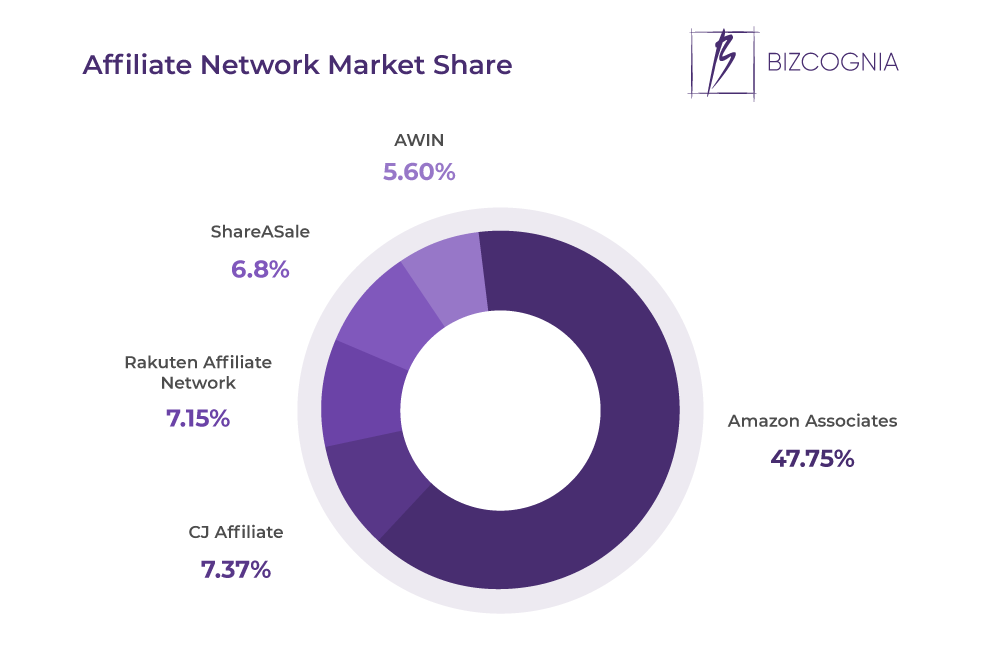

Of them, Amazon Associates holds the largest market share at 47.69%.

CJ and Rakuten each hold 7.38% and 7.16% of the affiliate network market share, followed by ShareASale with 6.82% and Awin with 5.61%.

Combined, other affiliate networks make up 25.34% of the total market share.

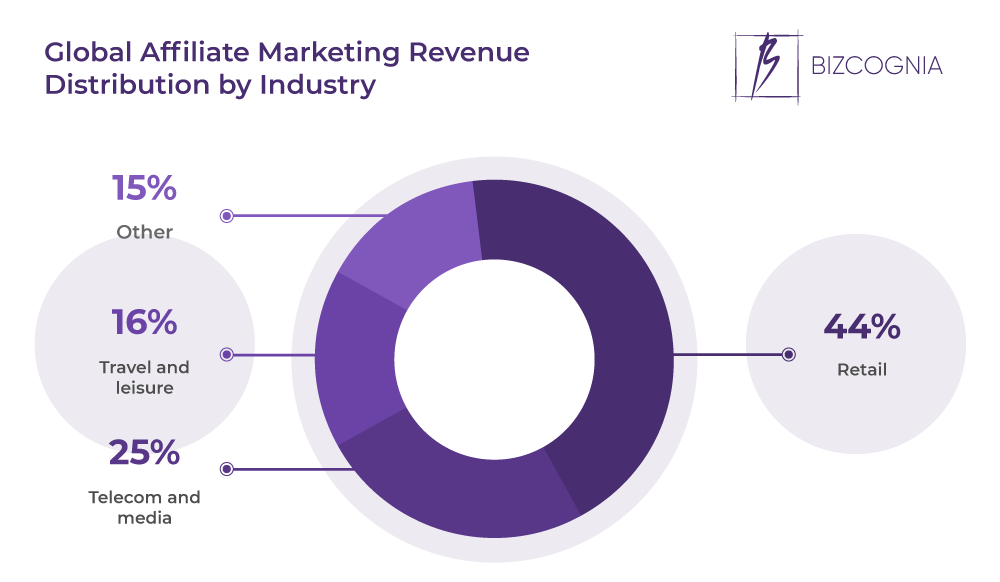

At 44%, the largest portion of the global affiliate marketing revenue is generated in the retail industry.

The telecom and media industry ranks second at 25%, followed by travel and leisure at 16%. Another 15% of the affiliate marketing revenue is generated in other sectors.

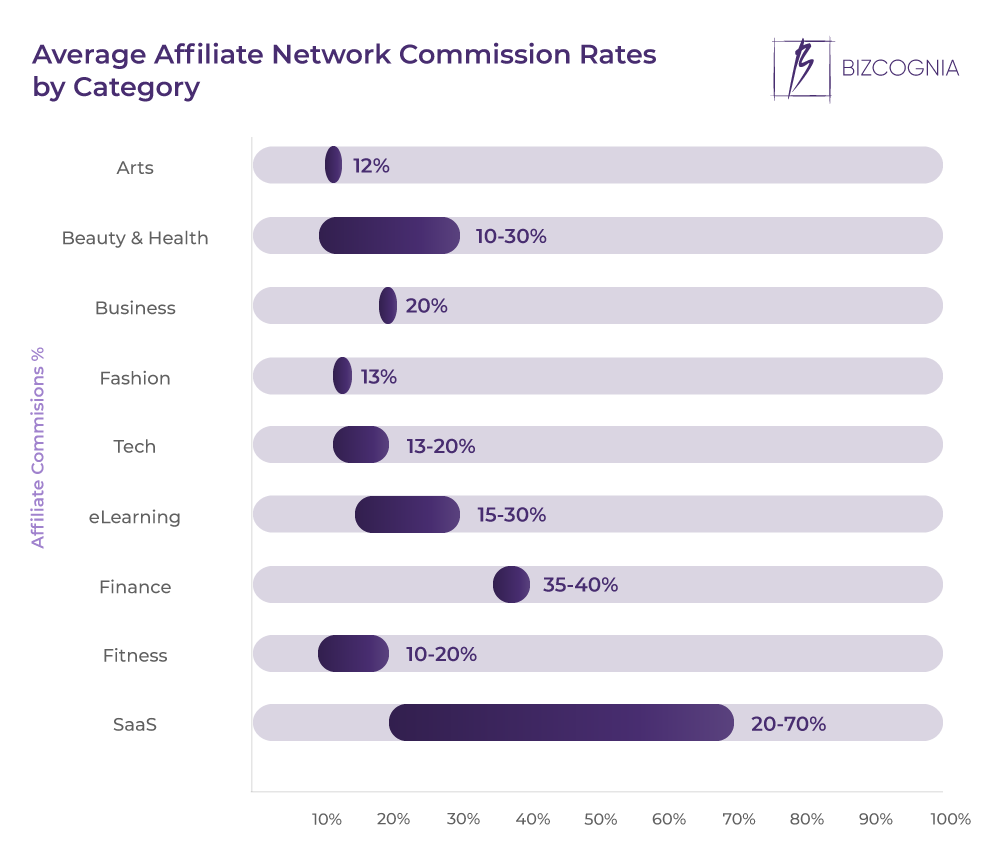

Starting from 20%, affiliate network commission rates in the SaaS category can reach as much as 70%.

Affiliate commission rates in finance range between 35% and 40%, those in eLearning between 15% and 30%, and those in beauty and health between 10% and 30%.

The tech category has affiliate commission rates in the 13%-20% range, and the ones in fitness are in the 10%-20% range.

The average affiliate commission rates in the business category are 20%, those in fashion are 13%, and those in arts are 12%.

Affiliate marketing fraud statistics estimate that the industry lost $3.4 billion to fraud in 2022.

The above figure marks a notable increase from the $1.4 billion recorded in 2020, when data on affiliate marketing scams revealed that nearly 10% of affiliate traffic was fake.

What’s more, 69.1% of affiliate marketers have experienced fraud, and another 67% are concerned about it.

Statistics on Affiliate Publishers

How many affiliate marketers are there?

While it’s difficult to estimate the exact number of affiliate marketers, the six most popular affiliate marketing networks worldwide are home to over 2.2 million affiliates.

84% of publishers create content for affiliate marketing.

Another 7% don’t, but plan to do so in the future, while 5% have created content for affiliate marketing but stopped.

Only 3% of publishers don’t create content for affiliate marketing nor plan to do so in the future.

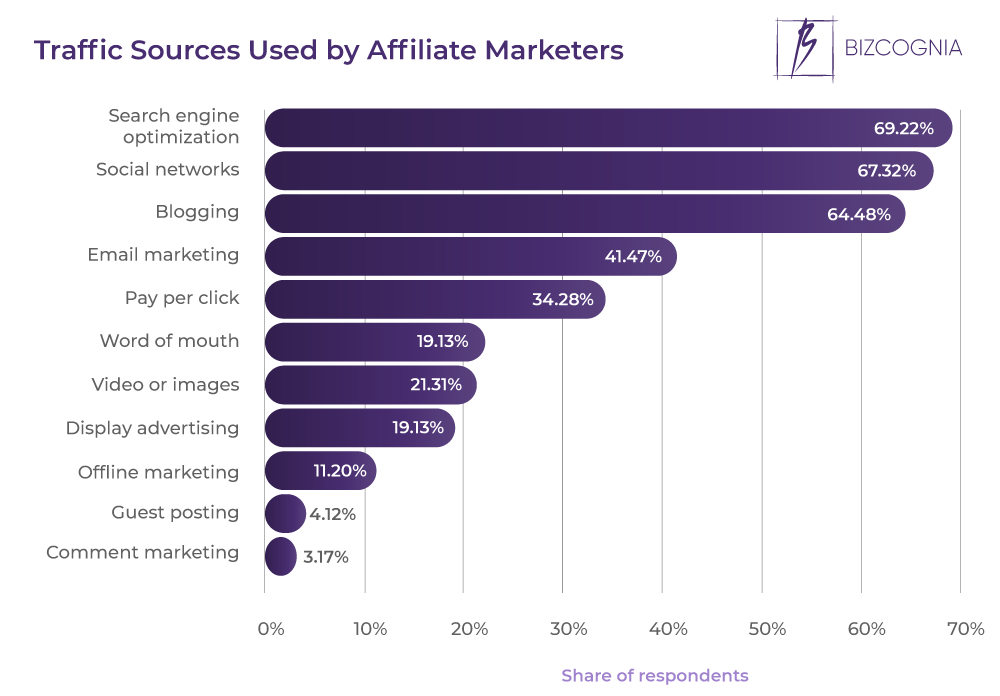

69.22% of affiliate marketers rely on search engine optimization as a traffic source.

Social media and blogging follow closely, with 67.32% and 64.48%, respectively.

Used by 41.47% and 34.28% of affiliate marketers, respectively, email marketing and PPC advertising round up the top five.

59.3% of affiliates promote B2C products.

B2C services rank second, promoted by 22.1% of affiliates.

Affiliates who promote B2B products and services account for 12.4% and 6.2%, respectively.

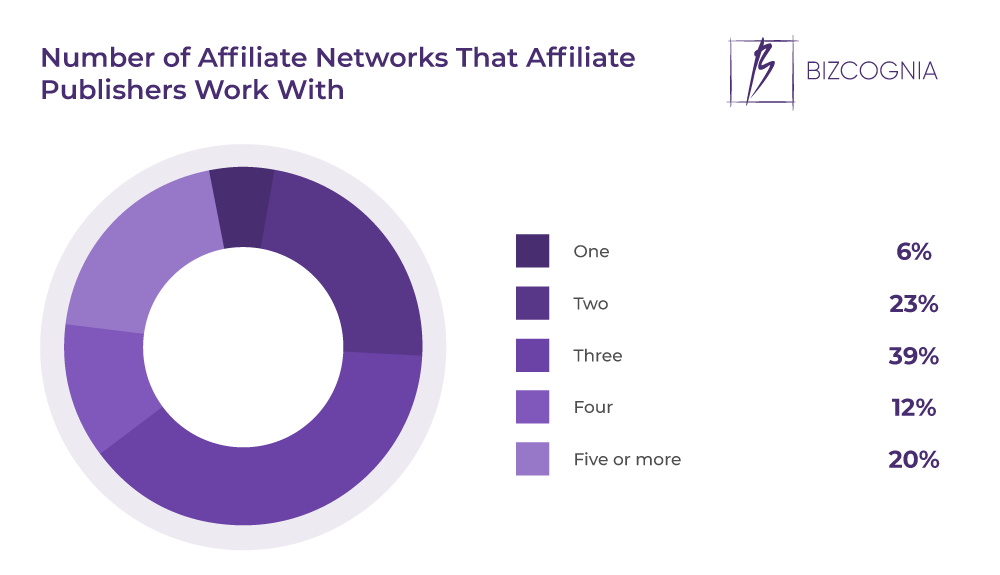

39% of affiliate publishers work with three affiliate networks.

The second-highest portion, or 23%, of affiliate publishers work with two, closely followed by the 20% who work with five or more affiliate networks.

12% of affiliate publishers work with four affiliate networks, while 6% do so with a single one.

54% of affiliate publishers rely on their networks’ reporting platforms to manage their affiliate marketing efforts.

46% rely on attribution tools purchased by a provider, while 36% use self-built reporting platforms, and 18% use self-built attribution tools.

However, 73% of affiliate marketers prefer SaaS solutions to affiliate networks to manage their affiliate marketing efforts.

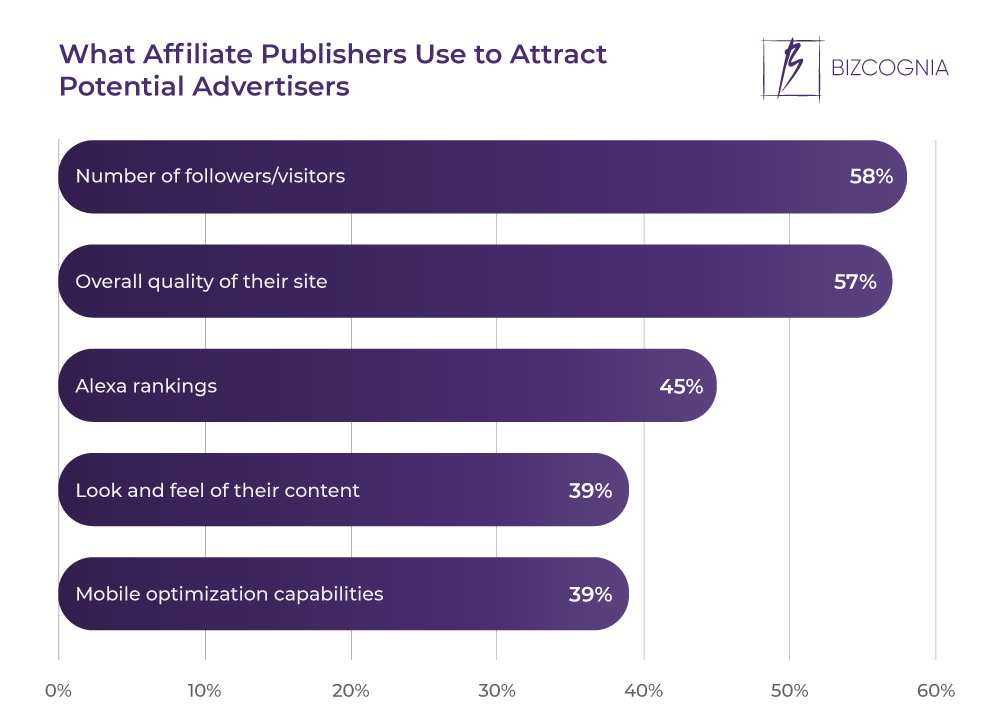

58% of affiliate publishers use their number of followers or visitors to attract potential advertisers.

This is immediately followed by the overall quality of their websites, as stated by 57% of affiliate publishers.

45% rely on Alexa rankings, while equal 39% portions use the look and feel of their content and their mobile optimization capabilities.

How much do affiliate marketers make?

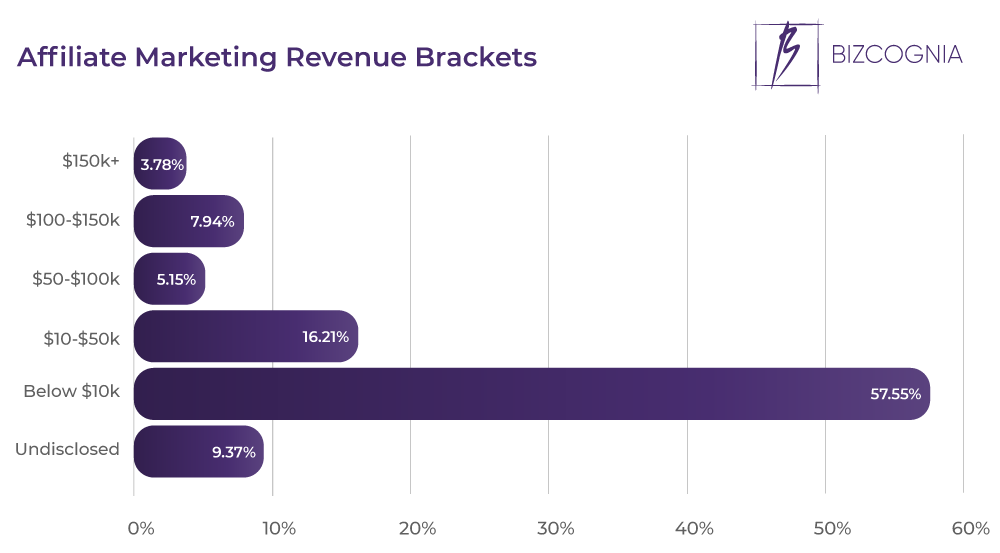

The second-highest portion consists of affiliate marketers who make between $10,000 and $50,000, followed by those earning $100,000-$150,000 at 7.94%, and those earning $50,000-$100,000 at 5.15%.

Only 3.78% of affiliates report making more than $150,000 from their affiliate marketing efforts.

Salaried affiliate marketers make an average of $54,404 a year.

The latest data suggests that the base affiliate marketing salary starts at $40,000, reaching $75,000 in some cases.

Bonuses in the industry range from as little as $546 to $8,000. The corresponding range for profit shares is $504-$6,000. Commission payouts to affiliate marketers range from $989 to as much as $22,000.

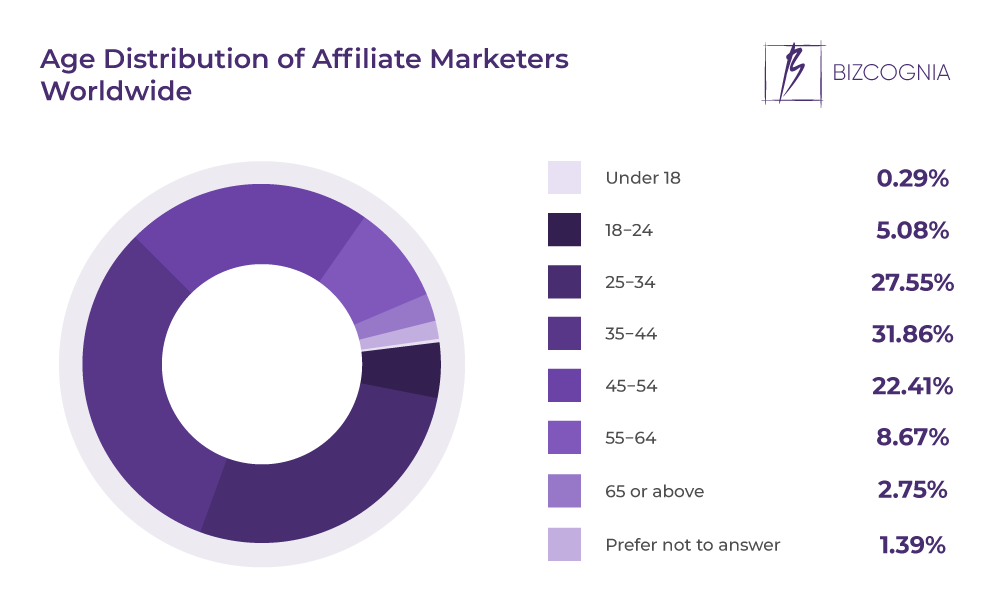

The majority, or 31.86%, of affiliate marketers are 35-44 years old.

The second-largest portion, or 27.55%, is made up of 25-34-year-olds, followed by 45-54-year-olds, who make up 22.41% of affiliate marketers.

Statistics on Entrepreneurs Using Affiliate Marketing

81% of advertisers include affiliate marketing in their overall marketing efforts.

Another 11% don’t, but plan to do so in the future, while 6% have included affiliate marketing in their overall marketing efforts but stopped.

Only 3% of publishers don’t include affiliate marketing in their overall marketing efforts nor plan to do so in the future.

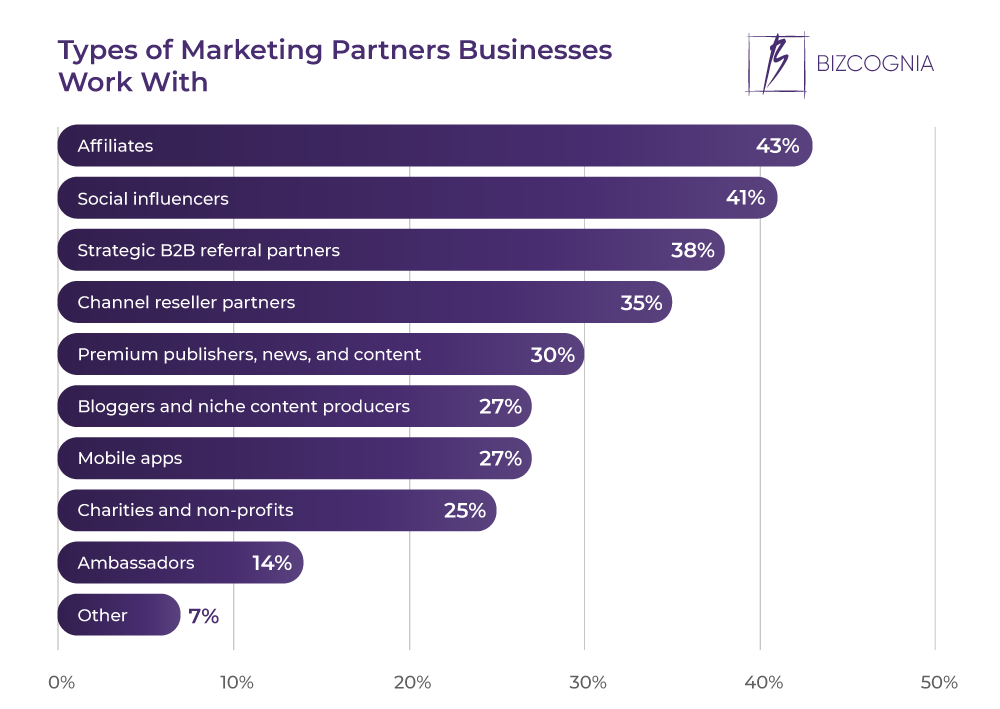

With 43% of organizations relying on it, affiliate marketing is the most common form of partnership marketing.

Social influencers follow closely, at 41%, while strategic B2B referral partners and channel resellers are used by 38% and 35% of businesses’ partnership marketing efforts, respectively.

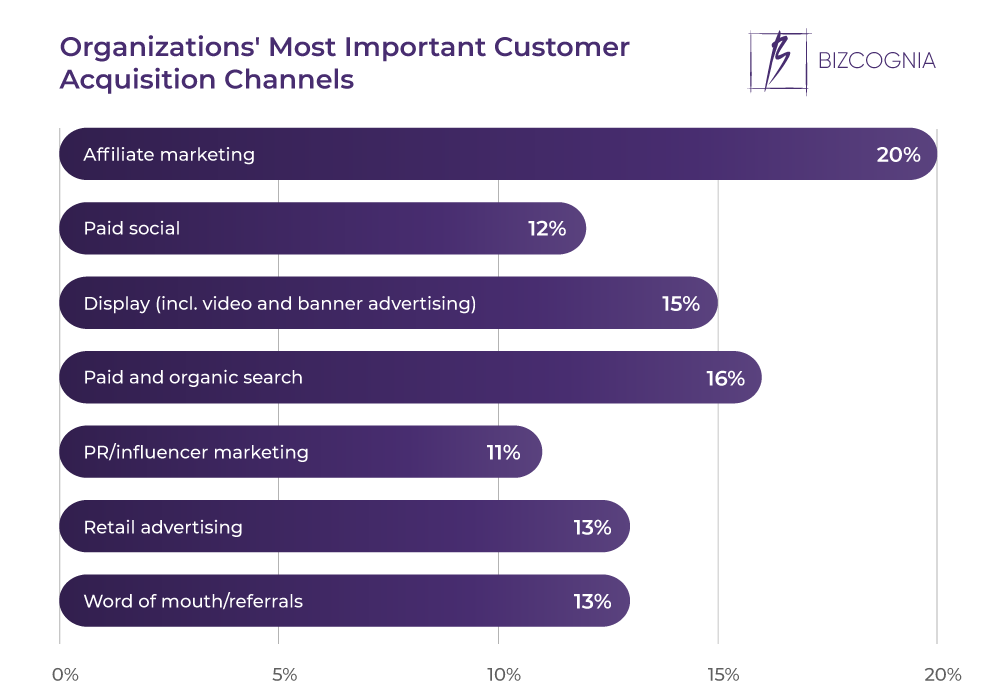

Affiliate marketing is the most important customer acquisition channel for 20% of marketers.

When it comes to organizations’ customer acquisition efforts, affiliate marketing outranks paid and organic search as well as display advertising, by five and four percentage points, respectively.

The latest affiliate marketing statistics reveal that it also ranks further above retail advertising, word-of-mouth/referral marketing, paid social, and PR/influencer marketing.

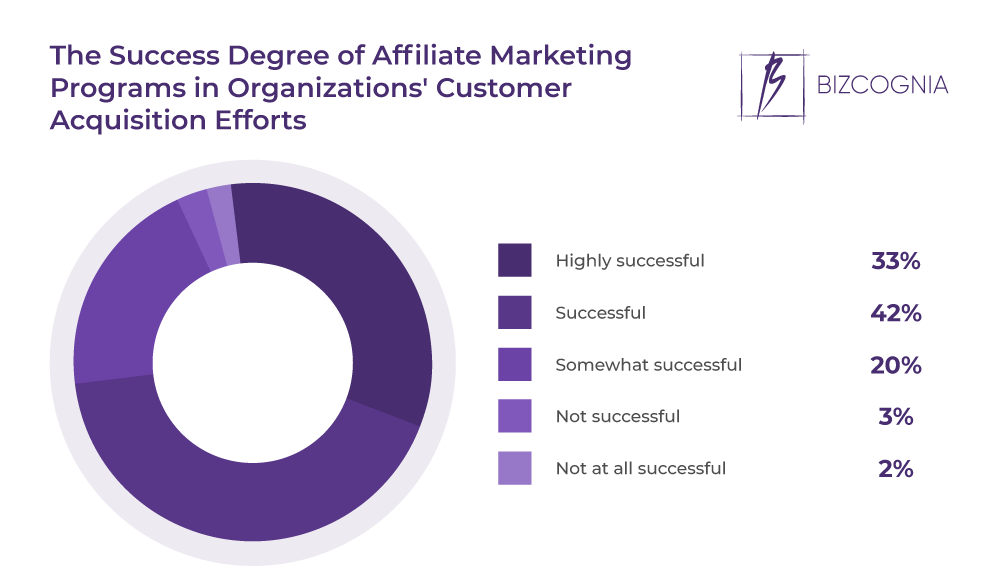

42% of marketers find affiliate marketing programs successful at driving their customer acquisition efforts.

Another 33% say they’re highly successful, while only 5% think they’re unsuccessful.

83% of advertisers use their affiliate marketing programs in the discovery or awareness stage of the customer lifecycle.

Equal 79% portions say the same for the conversion or purchase stage and ongoing customer engagement.

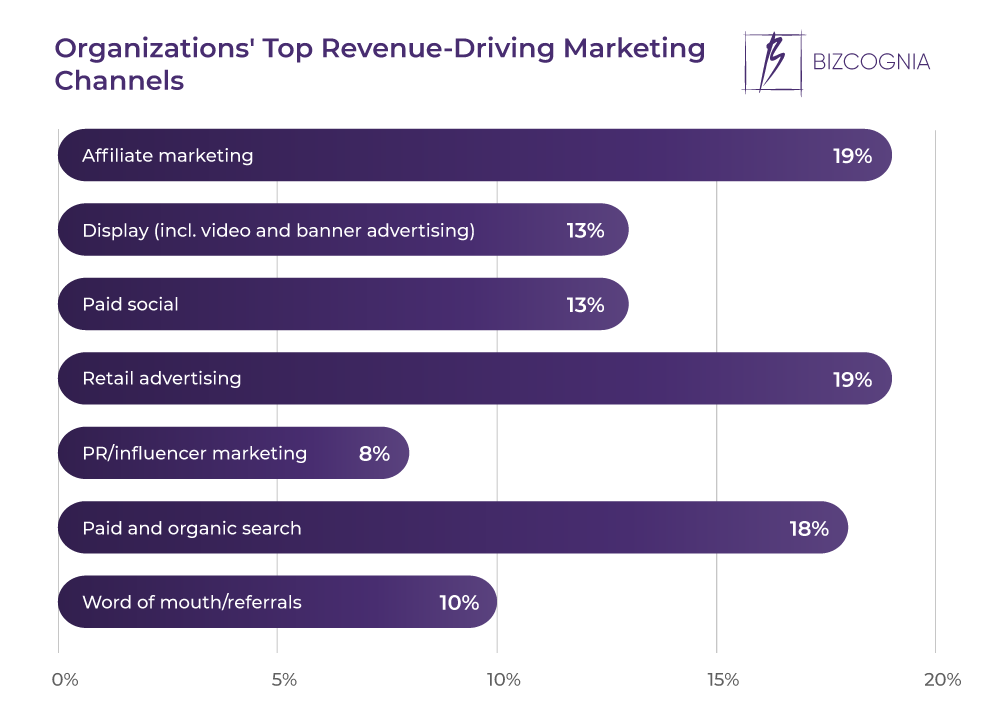

Along with retail advertising, affiliate marketing is the top revenue-driving channel for 19% of organizations.

Paid and organic search follows closely at 18%, while display and paid social advertising are the top-revenue channels for 13% of organizations.

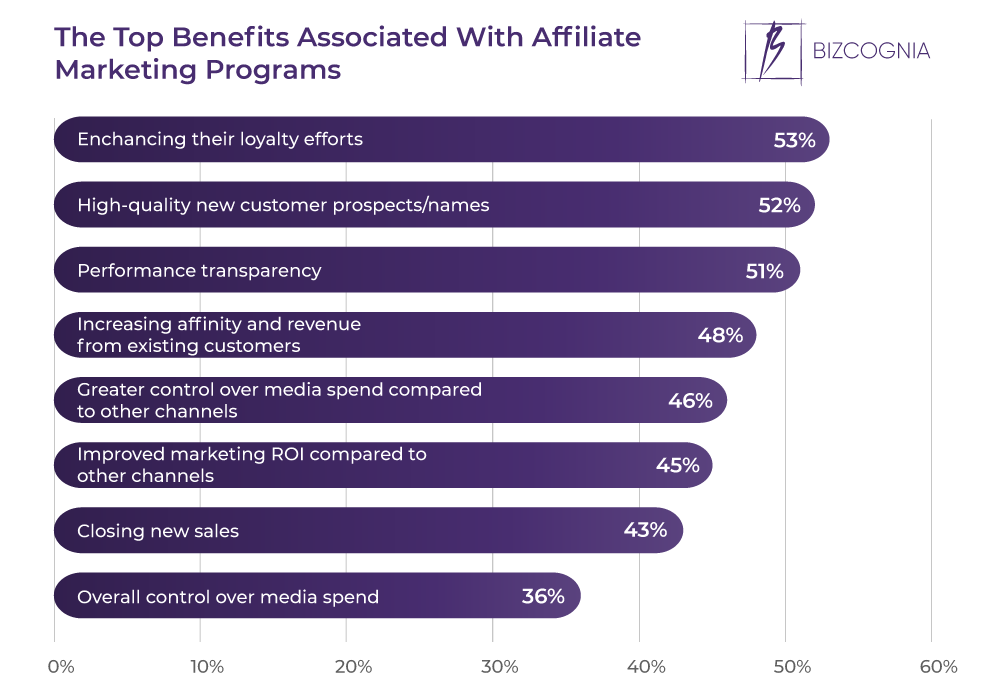

53% of organizations associate the enhancement of their loyalty efforts with their affiliate programs.

52% of organizations say the same about new high-quality prospects, and 51% associate performance transparency with their affiliate program.

Other affiliate marketing benefits include:

- Increasing affinity and revenue from existing customers (48%);

- Greater control over media spend compared to other channels (46%);

- Improved marketing ROI compared to other channels (45%);

- Closing new sales (43%);

- Overall control over media spend (36%).

59% of organizations agree that budget flexibility is (very) important when it comes to their affiliate programs.

While it’s somewhat important to 28%, and not (at all) important to only 13% of organizations, an interesting division emerges when it comes to the ways affiliate programs are funded.

Namely, 51% of organizations assign a fixed affiliate marketing budget at the start of their budgeting cycles, while 49% have a variable affiliate marketing budget based on revenue performance.

Affiliate programs pose less concern among organizations than other marketing channes.

Compared to paid social advertising, affiliate marketing is 40% less likely to raise concerns about rising costs and 44% less likely to do so about fraud.

Affiliate marketing stats further reveal that this channel is 16% less likely to raise ROI concerns than display advertising.

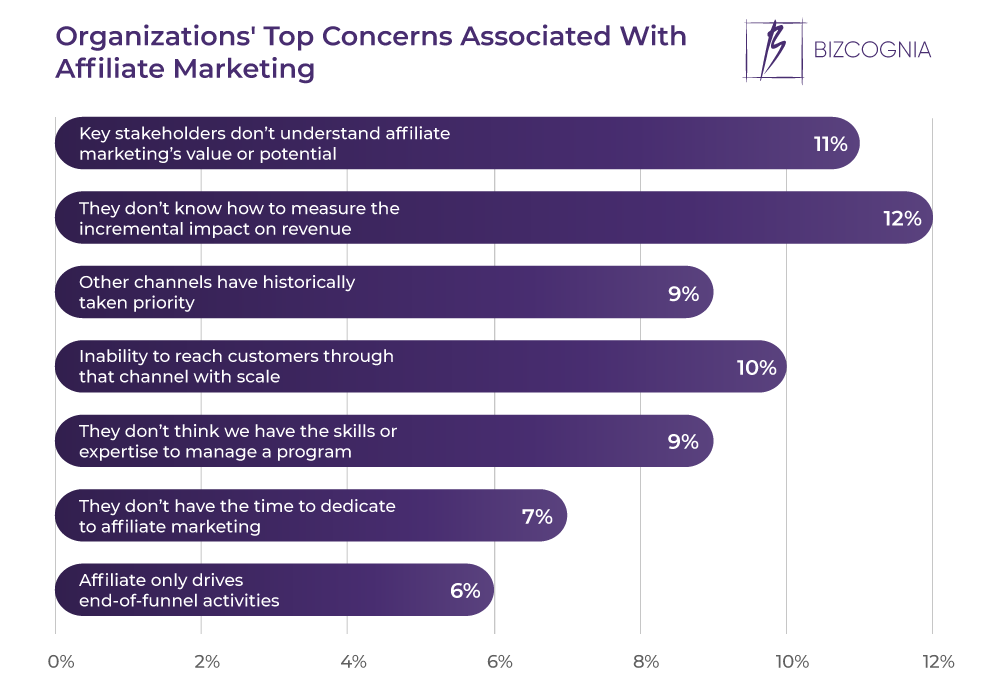

12% of organizations say that not knowing how to measure the incremental impact on revenue is their primary concern associated with affiliate marketing.

Key stakeholders’ lack of understanding of affiliate marketing’s value and potential follows closely at 11%, and so does the inability to reach customers at scale at 10%.

Equal 9% of organizations cite other channels having historically taken priority and the lack of skills and expertise to manage an affiliate program as their top concerns.

The lack of time is a concern for 7% of organizations, and having affiliate marketing drive only end-of-funnel activities is a concern for 6% of organizations.

83% of advertisers search within affiliate network dashboards to recruit new affiliates.

Attending events hosted by affiliate networks ranks second with 79%, while 56% host their own events.

71% of advertisers opt for a ‘join network’ button on their websites.

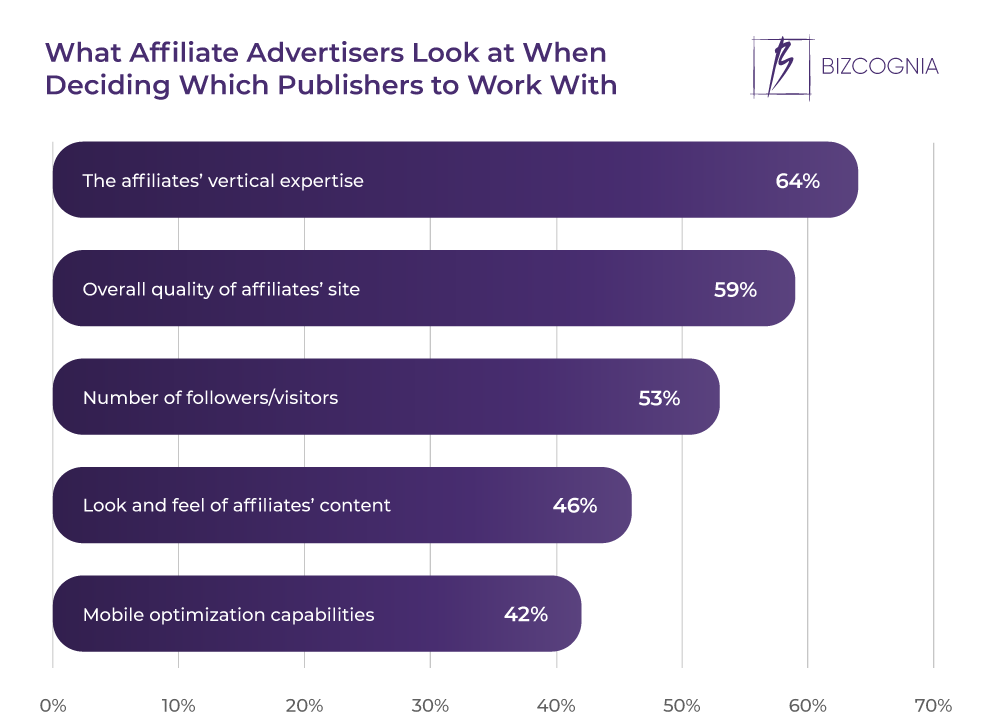

64% of advertisers rely on publishers’ vertical expertise when deciding which affiliates to work with.

59% rely on the overall quality of the publishers’ websites and 53% look at the number of followers or visitors.

The look and feel of the affiliates’ content and their mobile optimization capabilities are important to respective 46% and 42% of advertisers when choosing which publishers to work with.

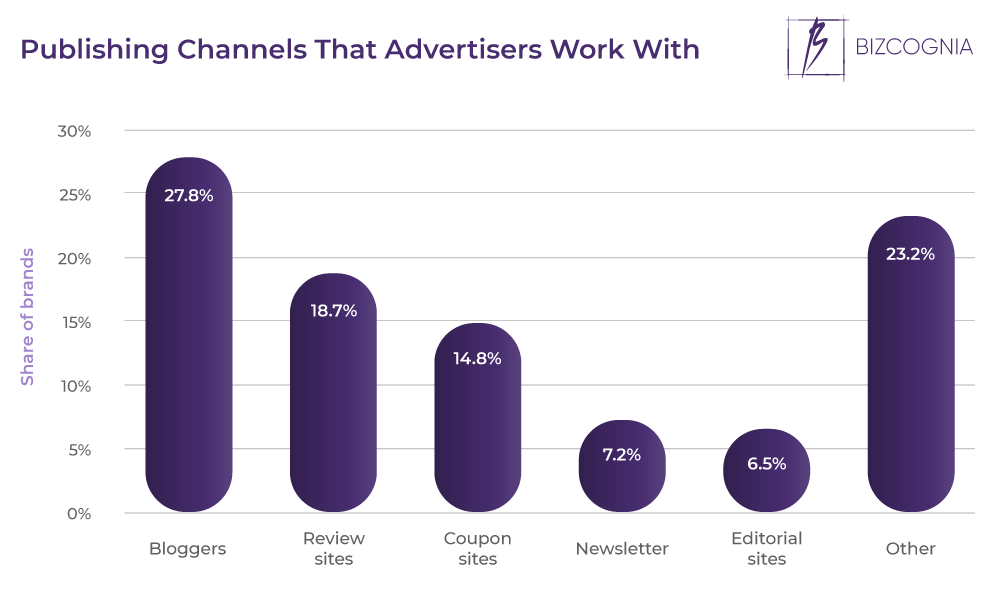

The majority, or 27.8%, of brands who engage in affiliate marketing work with bloggers.

Review sites rank second with 18.7%, followed by coupon sites with 14.8%.

7.2% of brands who engage in affiliate marketing work with newsletters, and 6.5% do so with editorial sites.

Additionally, 59% of brands work with influencers for their affiliate campaigns.

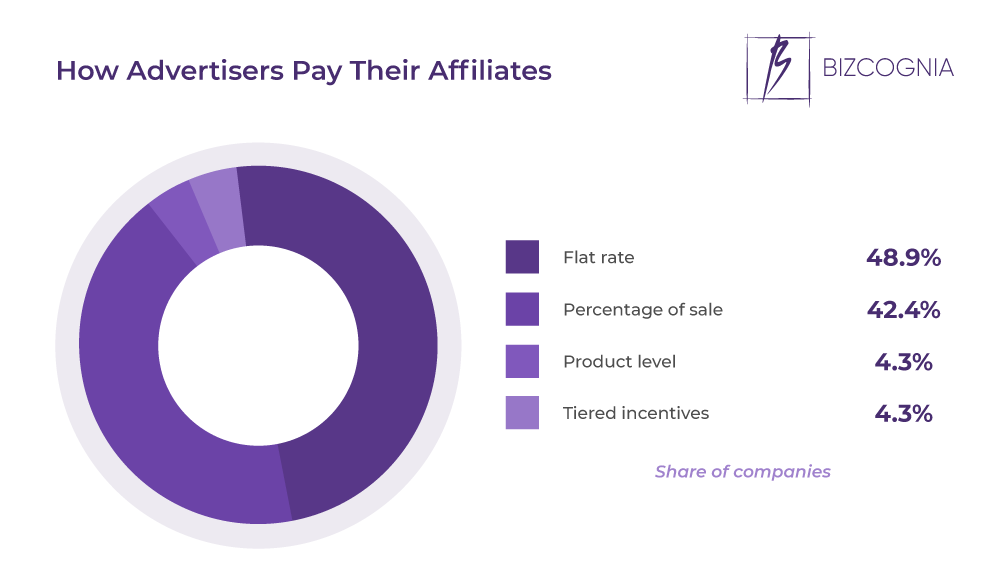

The majority, or 48.9%, of advertisers pay a flat rate to publishers.

Sales percentages are the most-second most common type of monetary reward, used by 42.4% of advertisers.

The least common ones are product levels and tiered incentives, each used by 4.3% of advertisers.

UK Affiliate Marketing Statistics

The Affiliate Marketing Industry in the UK

- Affiliate marketing spending in the UK is estimated at over £793 million.

- Just over 3% of the overall digital ad spend in the UK goes to affiliate marketing.

- Smartphone spending accounts for 41% of all affiliate spend in the UK.

- Affiliate marketing ROI in the UK is estimated at 1,500%.

- Affiliate marketing drives over 1% of the country’s GDP, which is more than the agricultural industry.

Affiliate Advertisers in the UK

- 51% of affiliate advertisers in the UK are large businesses with over 250 employees. 22% are mid-size businesses with 50-250 employees, 19% are small businesses with less than 50 employees, and 8% are startups in their first stages of operations.

- 76% of UK affiliate advertisers manage their affiliate programs in-house. 18% use an affiliate network, while 7% use an agency.

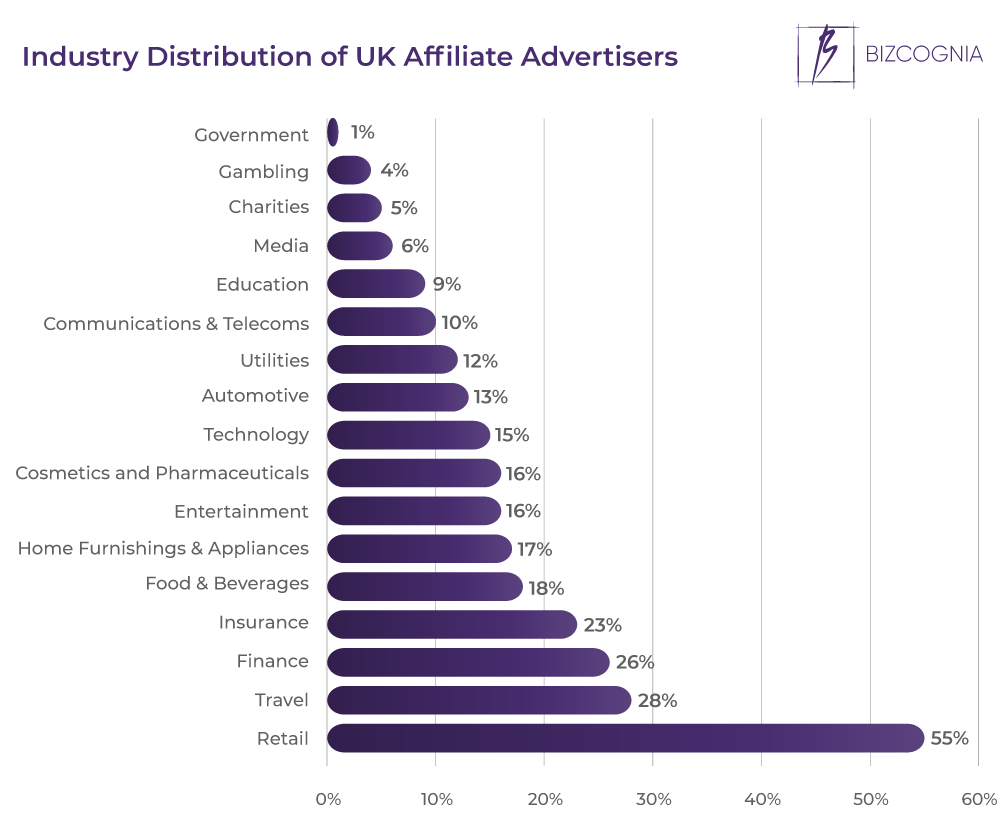

- 55% of affiliate advertisers in the UK operate in the retail industry.

- 51% of UK affiliate advertisers also operate in other European countries. 40% operate in the US, 24% in Australia, and 21% in Asia.

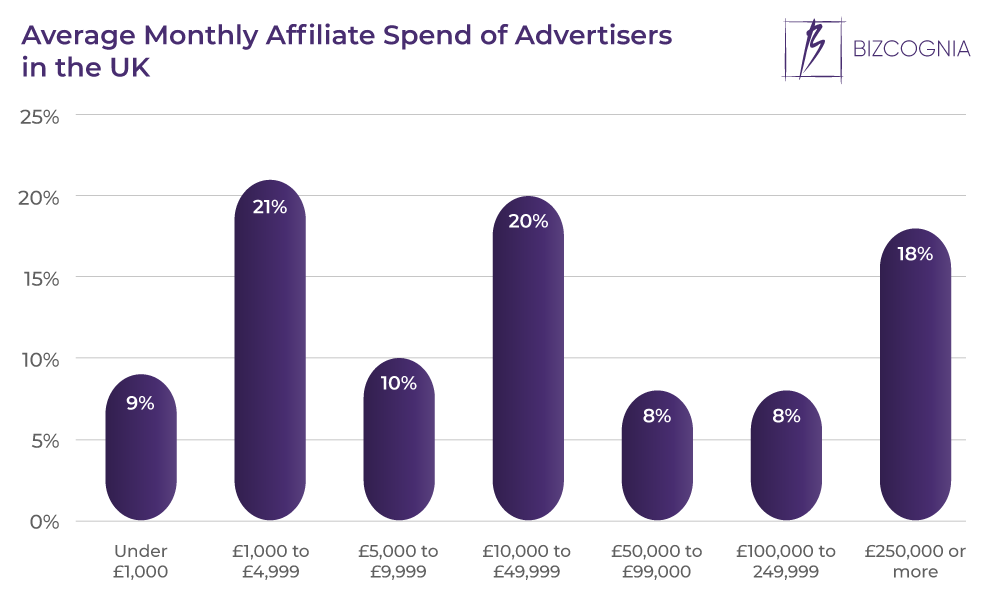

- 34% of advertisers in the UK spend over £50,000 per month on affiliate marketing.

- 86% of affiliate advertisers in the UK rely on the last click attribution model, i.e. they pay commission out entirely to the last referring affiliate partner. 14% use a custom attribution method where they pay multiple affiliate partners throughout the purchase journey, and 7% rely on the first click attribution model, i.e. they pay the first referring affiliate partner.

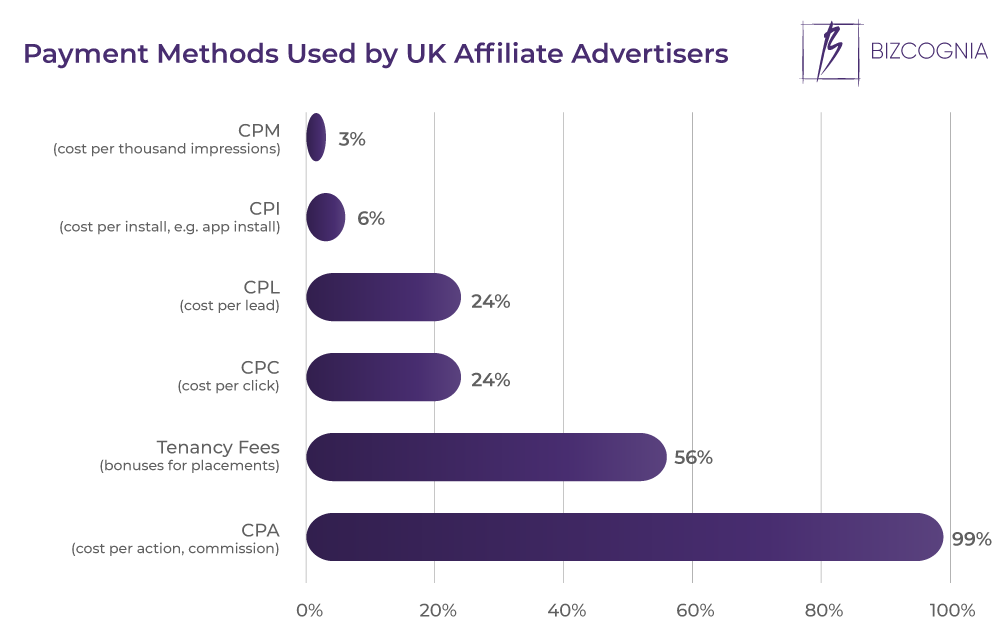

- 99% of UK affiliate advertisers rely on CPA as a payment method. Tenancy fees are the second-most-common payment method, used by 56%.

- In 80% of cases, it’s UK advertisers’ marketing departments that budget for affiliate marketing. In 31% of cases, it’s the eCommerce departments, while sales and product budget for affiliate marketing in 16% and 6% of cases, respectively.

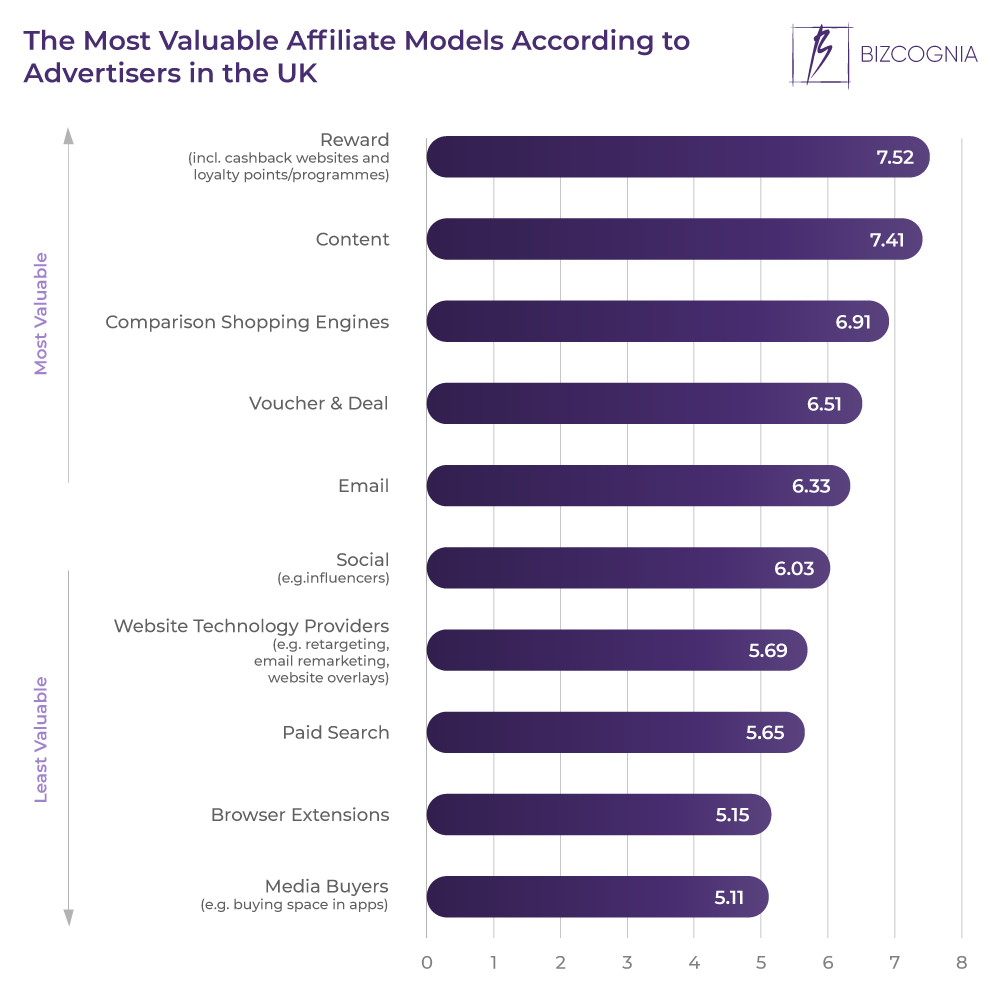

- Advertisers in the UK rank content and reward affiliate models as the most valuable ones.

- 77% of UK advertisers offer exclusive promotions to their affiliates.

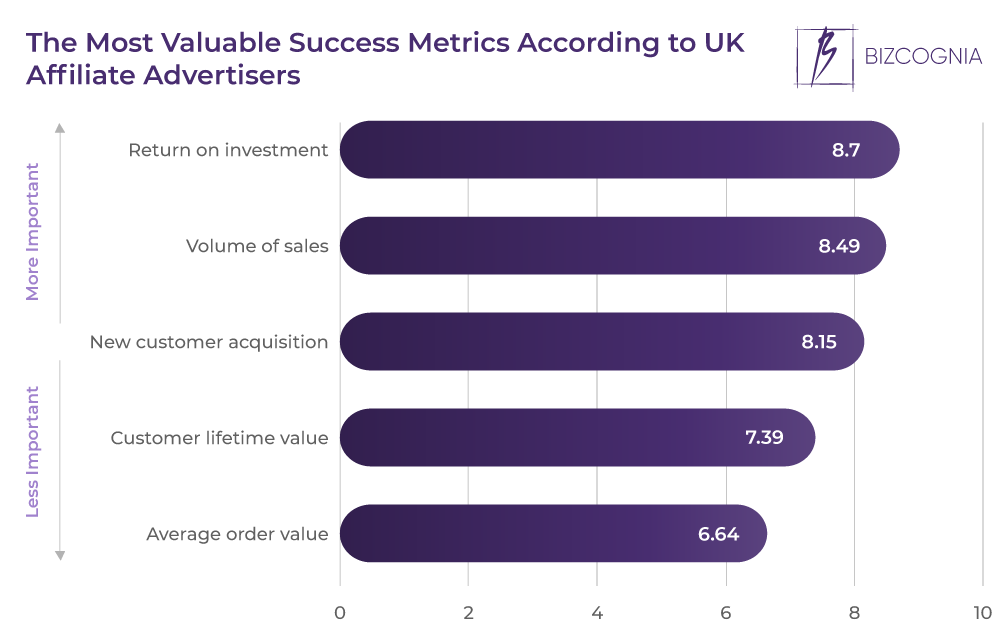

- UK affiliate advertisers rank ROI and sales volume as the most valuable success metrics.

- 51% of advertisers in the UK use third-party cookies to track their affiliate marketing activity. 42% use first-party cookies, and 35% use server-to-server tracking.

Affiliate Marketers in the UK

- Nearly 29% of European affiliate marketers are in the United Kingdom.

- UK affiliate marketers make an average of £43,000 per year. Affiliate marketing salaries typically range between £32,000 and £60,000, but can go as low as £24,000 or as high as £81,000.

Sources: CJ, Glassdoor, GlobeNewswire, Datanyze, Dentsu, IAB UK, Impact, Influencer Marketing Hub, Payscale, Pepperjam, PMA, PR Newswire, Rakuten Advertising, Statista, Statista, Statista, Statista, Statista, Statista, Statista, Statista, Supermetrics